Market trends of Choline Chloride and Vitamin A

This week’s feed additive update takes a look at the latest market trends of Choline Chloride and Vitamin A.

When we look at the cost structure of Choline Chloride there are 3 moving targets for us to keep track of:

- production of raw materials,

- shipping costs

- customer demand

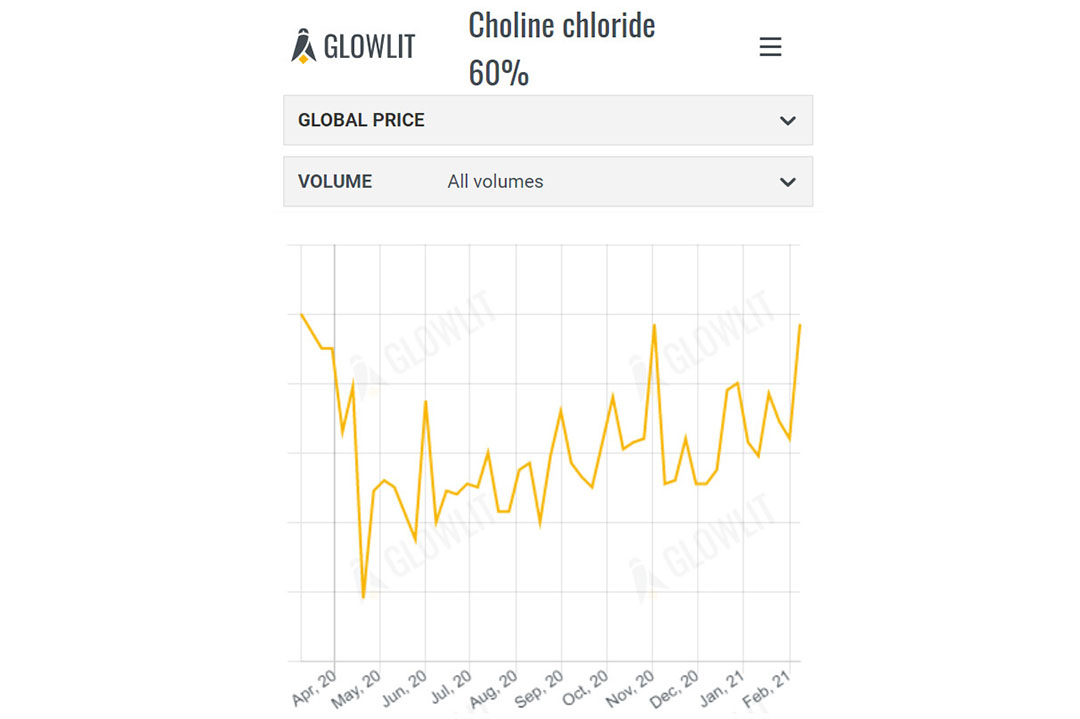

Supply problems cause price of Choline Chloride to rise

The main feedstocks for Choline Chloride are ethylene oxide (EO) and trimethylamine. The price increases that we saw in 2020 were due to fear of supply issues with EO. However, since then supply and price have stabilised.

With trimethylamine, however, the story is not so simple. With the Chinese new year beginning, counties across China have issued power outage restrictions on coal burning factories and other highly polluting industries. With the reduction in supply of coal to chemical factories, the supply of trimethylamine has decreased and with it we have seen an increase in price.

Traders adding shipping costs

Around the world companies are facing another problem. With shipping costs rising sharply and container availability uncertain, traders are adding up to around 40% of the product cost to the final price in order to cover shipping. While this isn’t a problem specific to Choline Chloride, it is compounding the aforementioned issues with feedstock availability.

Demand for Choline Chloride increasing

And lastly, we have the factor of customer demand, which is perhaps the hardest one to predict. On Glowlit we have seen user entries for Choline Chloride increasing in volume, suggesting that companies are placing increased orders to build up stock for the months to come. With procurement cycles becoming longer and producers unable to track actual final customer demand, we might see a price decrease as supply increases over demand in the summer months.

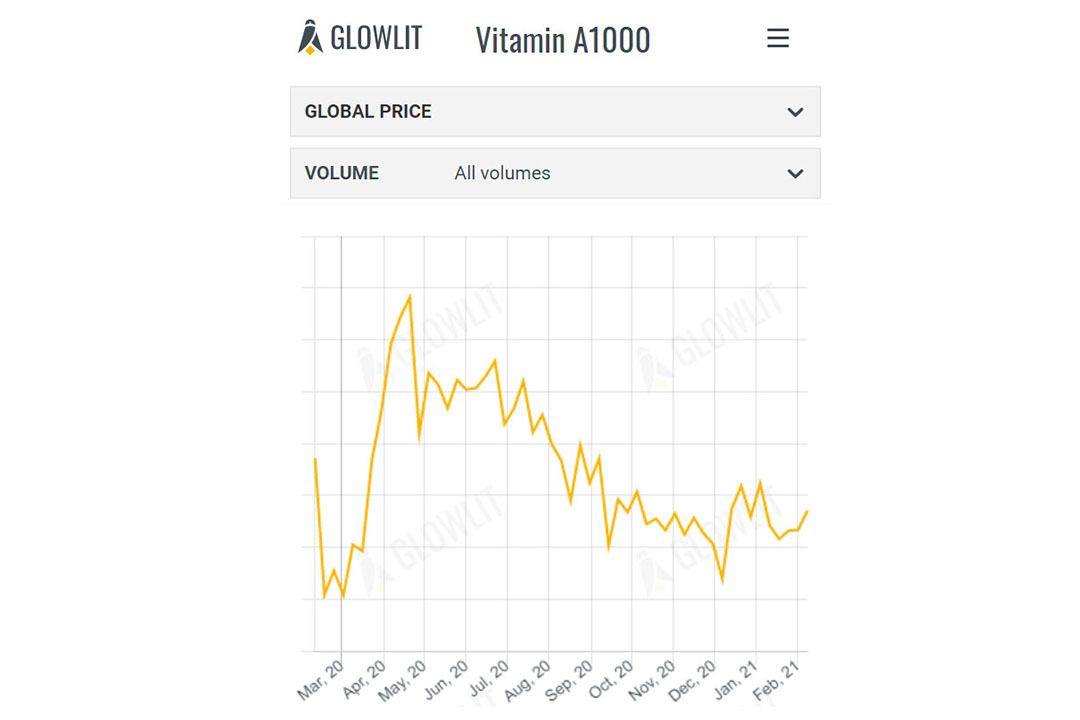

New source of key feedstock to Vitamin A

On January 27, 2021, Wanhua Chemical announced their intention to produce citral, a key feedstock to Vitamin A. This new source is in addition to Xinfa beginning to produce and supply vitamin A in the second half of 2019. Although both projects are limited in capacity, they represent a clear trend of releasing tightness in the market. We should see the price of vitamin A decrease in response.

Even with these new sources of production, suppliers still hold the key to what happens in the market. The production quality of EU origin Vitamin A has continued to provide an opportunity for the development of China’s Vitamin A industry.