Animal by-products in feed: A global update

No one would argue that animal by-products remain an important component of livestock feed around the world. Even though it still has to compete with soy, the future for these feed ingredients remains bright.

By 2027, Global Market Insights predicts that the animal protein feed ingredients market will be worth $ 280 billion. This is mainly due to the fact that the human population is expected to continue to grow, and with it a greater need for sustainable, high-quality protein.

Reducing fishmeal

And even though the aquaculture sector is trying to reduce, even eliminate, unsustainable fishmeal with protein and fats from plants, microbes or insects, Global Market insights predicts that fishmeal use in that sector will grow at a compound annual rate of over 4% to 2027.

Reducing soybean meal

It’s the same with trying to reduce even eliminate soybean meal (SBM) as a feed ingredient being imported into Europe from countries like Brazil and Argentina where the crop is not grown sustainably (on land that used to be rainforest). As explained in a recent All About Feed article, imported SBM from South America “is now seen as being unsustainable. The European Commission is keen to promote locally-sourced feeds to enhance its Circular Economy criteria.” However, a major current change in animal by-product use in the EU seems likely to lower the amount of SBM needed there. It’s one of several major factors affecting by-products at this time.

Lifting the PAP ban

Right now, the EU is in the process of overturning a ban on using processed animal protein (PAP) from non-ruminants (pigs and poultry) in feed for non-ruminants. The ban was a response to the BSE epidemic, which started in the UK in the 1980s and is generally accepted to have been caused by the incorporation of meat, bonemeal and especially nervous system tissue into livestock feed.

Dr Stefan Mack, head of service marketing for animal nutrition at Evonik, notes that much is unknown at this point about the cost, availability and use level of PAP that will occur in Europe after being banned for 20 years. In addition, PAP products can be diverse in their nutritional quality depending on the origin of the raw materials. He feels that “whilst feed manufacturers seem to generally welcome the option to use PAP, there are several factors which will likely limit its use based on the new regulation. One being that PAP can only be used in single-species feed mills. Their percentage in the EU is quite low.” He adds that in addition, “investments in process control and analytics to ensure compliance with regulations will be required.”

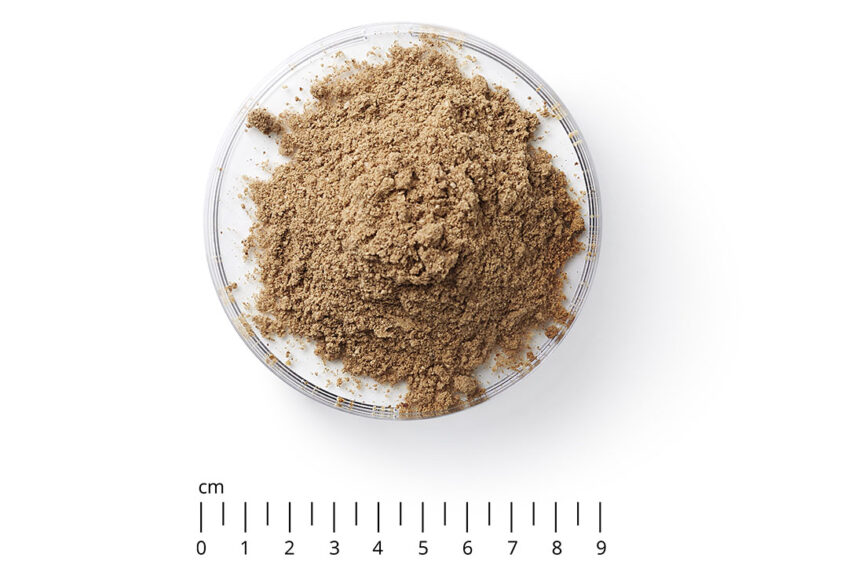

Nutritional value of non-ruminant PAP

For his part, Anton van den Brink (senior policy manager at FEFAC, the association of the European compound feed & premix industry, and executive director at EFFPA, which represents former foodstuff processors for livestock feed) first notes that the nutritional value of non-ruminant PAP is undisputed.

FEFAC would be cautious about assuming there would be any significant impact of the recent re-approval of porcine and poultry PAPs on imported soybeans.

Key challenges to re-introducing PAP

“However, for significant impact on the reduction of soybean imports, there are still some key challenges related to practical uptake of non-ruminant PAP, but also availability,” he says. “We should not forget that the porcine and poultry PAPs were already being partly absorbed by other, higher-value markets such as pet food and fish feed.” Van den Brink notes that approximately 0.5 million tonnes of PAPs is now going to be available for use in pig and poultry feed. He cautions, however, that sometimes “you can read a figure of 2.9 million tonnes, but this figure includes all types of PAPs (mixed PAPs and ruminant PAP).”

On that note, van den Brink points out that the reintroduction of ruminant PAP into livestock feed of any type has not even been discussed within the European Commission at this point. He believes that makes it highly unlikely that they will become available for livestock feed production within the 10 coming years. He partly bases this view on the fact that the current lifting of the feed ban on using non-ruminant processing by-products for non-ruminants took 11 years to become reality (it was first established as a target in the EU Commission ‘TSE Roadmap II’ in 2010).

Consumer acceptance of the use of PAP

Dr Mack and others also believe consumer acceptance on the use of PAP in European livestock production may play a role in how much will be used. However, van den Brink thinks that “on a local level, with dedicated production lines and favourable market conditions (in particular, general acceptance), there may well be feed companies that are able to absorb these resources.”

Still, in his view there is “limited scope” for widespread use of porcine and poultry PAPs in poultry and pig feed, and “FEFAC would be cautious about assuming there would be any significant impact of the recent re-approval of porcine and poultry PAPs on imported soybeans.” There is also another consumer issues at play. For various reasons, consumers in many countries are attracted to buying poultry meat from birds fed only plant-based feed. Dr Janet Remus, senior technical director at Danisco US, adds that whilst pork, beef or poultry meals (or blends of these) have been used successfully for many years in the US to feed poultry, “in recent years, the move to ‘no antibiotics ever’ and ‘raised without antibiotics’ programmes in broiler chicken has also moved more feed tonnage to all-vegetable-based feeding programmes.”

Other factors

There are other factors such as quality/digestibility, consistency and availability of by-products that will affect how they are used. Dr Remus points out that whilst all types (poultry, pork or beef) of by-products are available, pork or beef can see more use in livestock feed, where poultry meal has found increasing use in the pet food sector. In addition, “for swine, high-quality pet food grade poultry meal can be used in nursery feeds.” Dr Remus adds that if soybean meal, the key protein used in swine and poultry diets, is short on supply and therefore higher in price, “then animal by-product meals will price into feeds at higher levels.”

Value of rendered products in feed

Looking forward, Dr David Meeker notes that the functionality, economics, nutritional value and advantages of feeding rendered products to both swine and poultry have been very well established by research worldwide. Dr Meeker is the senior vice president of scientific services at the North American Renderers Association (NARA) and director of research at the US-based Fats and Proteins Research Foundation (FPRF). He says that although FPRF has put more emphasis over the last 15 years into other areas of research (such as aquaculture, pet food, validation of thermal processes, new markets etc.), “the use of rendered products in animal diets remains one of our top priorities. The global tight supplies of animal feed ingredients ensure continued demand for rendered products and FPRF will continue to support these markets with targeted research.”