Shifts in vitamin B5 and threonine supply

This weeks feed additives update takes a look at the latest market trends of vitamin B5 and threonine.

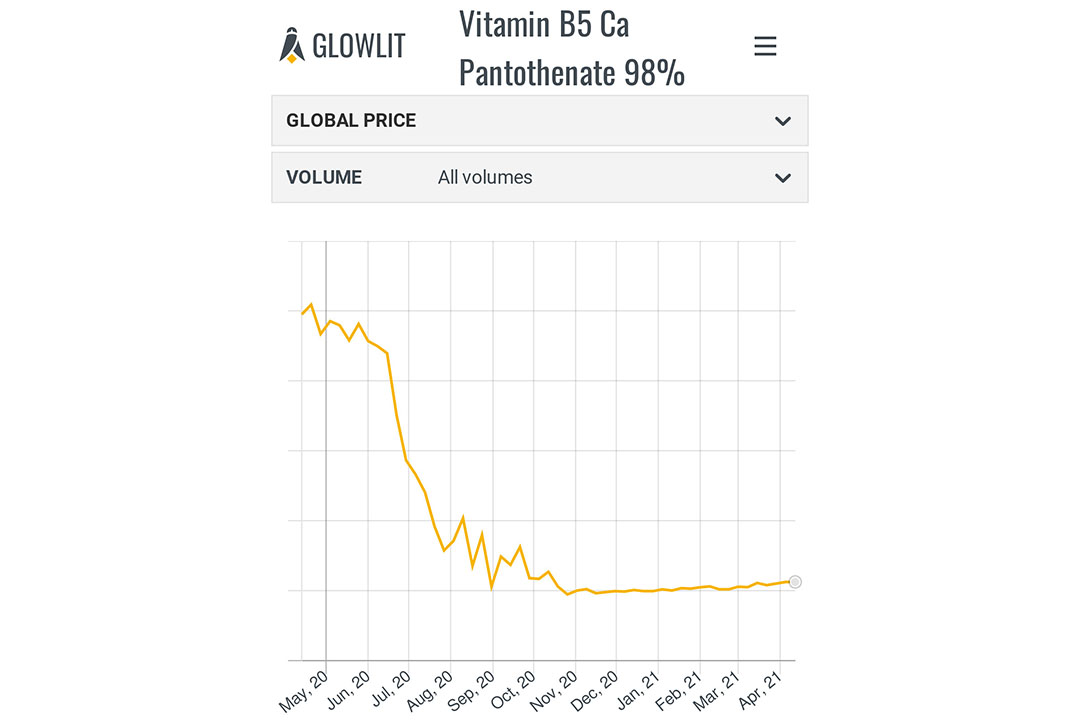

Several recent developments related to Calpan (vitamin B5) have buyers bracing for a shift in the market.

Huazhong and DSM’s actions impact vitamin B5 price

On April 7th, Huazhong Pharmaceutical announced that it will be acquiring Zaoyang Jin‘ante Chemical Co. as a wholly-owned subsidiary. Jin‘ante has the production technology for critical Vitamin B5 intermediates. Through this acquisition, Huazhong Pharmaceutical has perfected the vitamin B5 production chain. Additionally, DSM has announced that the price of calcium pantothenate has increased by 40%. Both pieces of news indicate upward movement in price.

Pig and poultry feed consumption below expectations

At the same time, Ningxia Youwei Biotechnology has announced an expansion of 4,000 tons per year for its vitamin B5 project. Both pig and poultry feed consumption across China is not meeting previously projected expectations, leading to relatively weak downstream demand and higher availability of stock. Stock from the Spring Festival period has yet to be fully utilised. In line with this weaker demand, Glowlit shows little movement in price despite the announcements from DSM and Huazhong Pharmaceutical.

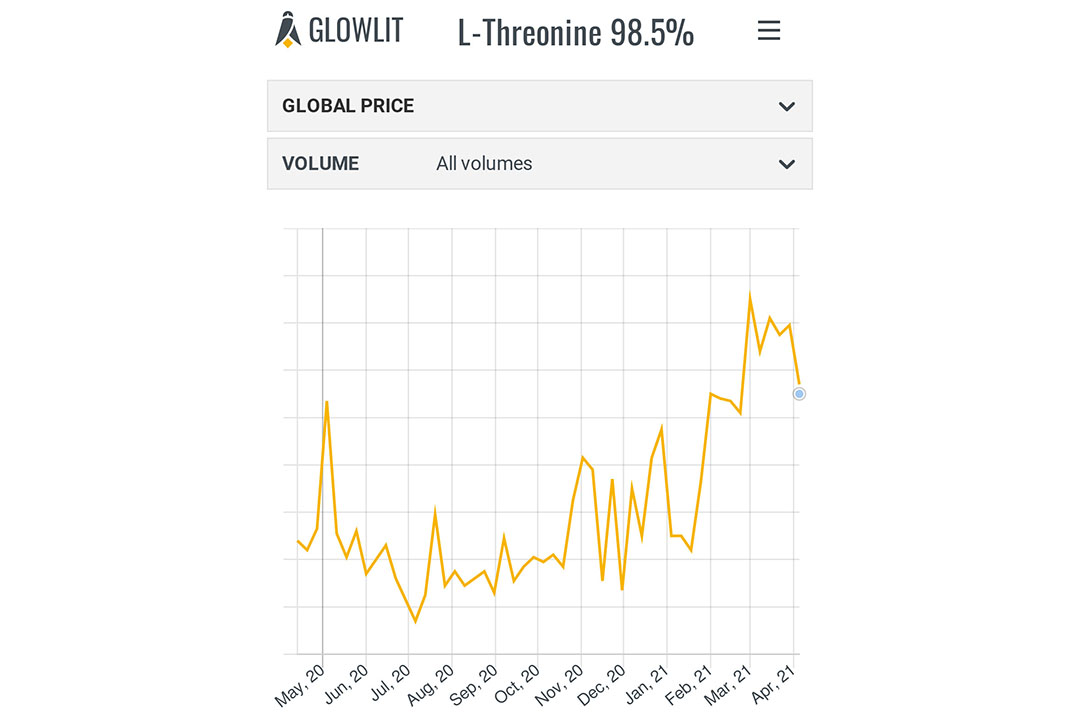

China’s supply is over 95% of global total

The amino acids market is still waiting on the impact of new environmental regulations from Inner Mongolia. This is the home of the production facilities for the top 3 manufacturers of threonine globally. With the closure of many threonine production lines around the world, China’s supply now accounts for more than 95% of the global total. Over 52% of China’s Threonine production is located in Inner Mongolia. Between Eppen’s factory in Chifeng, Meihua’s factory in Tongliao and Fufeng’s factory in Zhalantun, there is a production capacity of approximately 390,000 MT per year. Any production reductions in Inner Mongolia will have an enormous impact on the global supply chain.

China’s plan to replace/reduce corn and soybean meal in feeds

With so much of the global capacity located in one place, announcements are critical for understanding future trends. Similarly, with so much of the global demand coming from China, we can draw a number of conclusions based on the state of Chinese demand which has a direct impact on Chinese production. On the demand side, the Animal Husbandry and Veterinary Bureau of the Ministry of Agriculture and Rural Affairs issued a work programme aimed at reducing or replacing corn and soybean meal in feeds. This plan should be fully implemented within 1-2 months. This change in core feed ingredients will challenge Chinese nutritionists as formulations are rebalanced, fundamentally altering feed additive demand.