Compound feed output in Russia

There is quite a variation in estimates of compound feed production in Russia as seen in the table below because of:

•The large differences in total feed production caused by the differing

estimates and definitions of on-farm compound feed production. Industry sources

apply the strictest definition of balanced feed rations, whereas the compound

feed output figure and calculated feed use figure levels of on-farm feed

estimates and definitions of on-farm compound feed production. Industry sources

apply the strictest definition of balanced feed rations, whereas the compound

feed output figure and calculated feed use figure levels of on-farm feed

•It is difficult to estimate the market size and

growth of the Russiona feed market as

growth of the Russiona feed market as

- Different sources have differing opinions

- The definition of feed is not always clear

- Double counting exists, for example in adding captive and commercial feed

together to gain an estimate of industrial feed (because concentrates/premixes

are sold to integrators)

The volume of the Russian compound feed

market :

market :

- 2005-2006 – approximately $2.4-2.9 billion

- 2006-2007 – estimated $3.1-3.5 billion

- up to 2011 it will reach $4.1-4.5 billion.

The volume of Russian premix/additives

market:

market:

- 2006/2007 is in the range of $145-155 million.

At present the most successful are those compound feed factories, which are

integrated into large agribusiness holdings. Vertical integration is typical not

only for holdings, but for independent poultry and animal operations as well:

they invest in their own compound feed production. Large compound feed factories

can compete with own feed productions units if they offer additional services

and answer demand of clients: offer free consulting in animal feeding, more

flexible and convenient product delivery schemes.

integrated into large agribusiness holdings. Vertical integration is typical not

only for holdings, but for independent poultry and animal operations as well:

they invest in their own compound feed production. Large compound feed factories

can compete with own feed productions units if they offer additional services

and answer demand of clients: offer free consulting in animal feeding, more

flexible and convenient product delivery schemes.

There are over 100 local distributor companies in Russia who supply a full

range of feed ingredients to compound feed factories, independent feed mills,

agro holdings, poultry, swine and dairy farms. Most successful are those who

keep their own distribution network and offer feed programs with balanced feeds.

These distributors are very flexible and can provide all kinds of feed

ingredients from amino acids to enzymes to the clients upon their request.

range of feed ingredients to compound feed factories, independent feed mills,

agro holdings, poultry, swine and dairy farms. Most successful are those who

keep their own distribution network and offer feed programs with balanced feeds.

These distributors are very flexible and can provide all kinds of feed

ingredients from amino acids to enzymes to the clients upon their request.

The leading player is Provimi with six feed plants and one premix production

line to supply its feed plants – a solid distributor network. Provimi is the

only foreign player active in several regions. Furthermore, a large number of

local feed companies operate in the market.

line to supply its feed plants – a solid distributor network. Provimi is the

only foreign player active in several regions. Furthermore, a large number of

local feed companies operate in the market.

However, industry success indicates that most of the local players are

unprofitable.

unprofitable.

There are three main types of feed

producing outfits in Russia :

producing outfits in Russia :

- Compound feed enterprises

- Grain mills

- Grain elevators

The Federal State Statistics Services indicates that 65% of feed is produced

by independent feed mills and the remaining part by integrations. However,

industry sources estimate current independent production around 1/3 of total

industrial feed production.

by independent feed mills and the remaining part by integrations. However,

industry sources estimate current independent production around 1/3 of total

industrial feed production.

Agri complexes particularly broiler farms and swine producers have started to

produce their own feed in order to improve control over cost and quality.

produce their own feed in order to improve control over cost and quality.

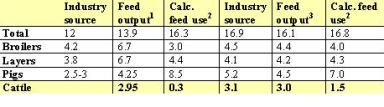

Estimates for feed production in Russia 2004-2006, million tonnes

- Based on statistics from Federal Statistics Services

(FSS). These figures include balanced feeding blends used by all type of

animals, including slaughter cattle. - Based on FAO production figures for pork, poultry,

eggs and milk production (excluding feed for slaughter cattle), 2006 industry

sources (Provimi, IBS), FAO, FSS - Based on statistics from FSS. These figures include balanced feeding

blends used by all type of animals, including slaughter cattle.

Source: NRA Bulletin, Jul-Sept 2007