GrainCorp buys fourth largest malting company

GrainCorp Ltd. of Australia has purchased United Malt Holdings group, the world’s fourth largest commercial malt manufacturer.

In doing so it has transformed itself into an international agribusiness, with operations in Australia, the United States, Canada and the United Kingdom.

GrainCorp Ltd. of Australia agreed to buy United Malt Holdings Ltd. for $655 million, doubling in size by adding the world’s fourth-largest manufacturer of malt used to make beer and whisky.

Buying United Malt from buyout firms Castle Harlan Inc. and Champ Private Equity will give GrainCorp customers such as brewer Foster’s Group Ltd. along with operations in the US, the UK and Canada. It will also reduce GrainCorp’s reliance on seasonal cropping conditions in Australia.

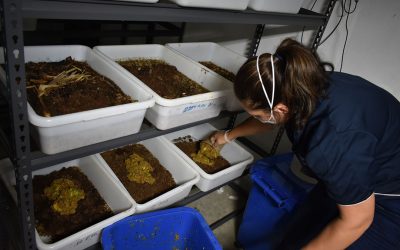

United Malt operates 14 malt houses and currently produces about 1 million tonnes of malt a year, GrainCorp said. That will rise to 1.2 million tons, the company said. It has more than 800 customers in the brewing and distilling sector.

United Malt is made up of four companies including Great Western Malting in the US, Canada Malting in Canada, Barrett Burston Malting in Australia and Bairds Malt in the UK.

GrainCorp operates seven bulk grain export terminals in eastern Australia and has grain storage capacity of as much as 20 million tonnes.

It trades more than 3 million tonnes of grain a year and is Australia’s largest producer of flour through its partnership in Allied Mills.