Industrial Compound Feed Product

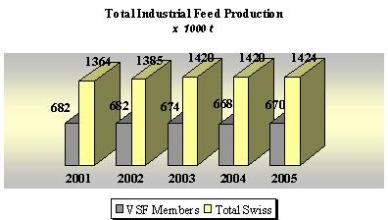

Accurate statistics for Switzerland are not available because the fenaco-group and the small local feed millers do not publish their manufactured feed tonnage. The United Swiss Feed millers (VSF) estimate that in 2005 around 1,424 million tonnes of compound feed were manufactured.

Compound feed production figures in Switzerland are reported by the VSF only.

This organisation represents 70 compound feed manufacturers, which represent 47%

of total feed production. Cooperatives (UFA in the fenaco-group, Haefliger and

local cooperatives) have a 48% share and the remaining 5% is filled in by local

manufacturers.

VSF-members could increase their production with 0.2% compared to 2004. The

manufactured 669,500 tonnes of compound feed, concentrates and premixes.

| |

| Note: Total Swiss figures estimated |

The Swiss dairy market in 2005 showed great turbulence. The oligopoly on the

processing side, the forthcoming abolition of milk quota as well as the complete

liberalisation of the cheese market in 2007 require large efforts on all stages

of the milk market. Despite these facts compound feed production for the dairy

cattle sector could be raised with + 1.3% to 124,000 tonnes. This was remarkable

because through the whole of 2005 abundant roughage was available. Harvest and

pasture were possible to the beginning of winter. The share of compound feed for

dairy increased from 20.3% to 20.5% compared to 2004.

Feed production for beef was also on the increase with 3.6% to 21,000 tonnes.

Consumption of beef developed positively with an increase of 2.1%. The BSE

discussions seem to belong to the past. The collapse of the protein concentrates

for beef cattle (- 42.2%) could not be explained. It might be a statistical

error.

Pig meat production rose considerable with 4,0%, while pork consumption on

improved 2,1% which led to an increase of the self-sufficiency degree with

serious impact on the markets. The fact that under these conditions also an

increase of the pig feed production was registered is no surprise, However, the

upward figure is only 1,2% and does not match with the increase in pork

production. The question remains open, who profited from the extra production.

Pig feed remains the strong pillar in the compound feed industry. The pig feed

production amounted to 198,200 tonnes (+ 1.2%). Total output improved in the

year under report a little over 0.5% to a 42.9% share.

For three years in a row production of poultry feed is declining. In 2004 a

strong reduction was observed (-7.8%) in broiler feed, but in 2005 this downward

trend could be stopped despite bird flu. Layer feed however saw a decrease of

2.7%. Altogether 151,300 tonnes (-1.6%) of poultry feed were manufactured, which

is 2,500 tonnes less than in 2004. Poultry feed sales among VSF members has a

share of 23.2%.

The total Swiss production of milkreplacers suffered a production loss of

10.9% in the year under report in accordance with TSM statistics (of 18,338

tonnes to 16,342 tonnes). Both veal consumption (-2.7%) as well as veal

production (-4.1%) developed declining.

The very high 2005 milk powder prices are further depressing the market and

do not promise any positive perspectives for the future.

In other categories of farm animals the compound feed production declined

too. Feed for rabbits lost 7.3% and horse feed production came down with 5.4%.

There is hardly any commercial rabbit farmer left and the rabbit feed is more

and more bought at the pet food section in the wholesale

department.

Source: Vereinigung Schweizerischer

Futtermittelfabrikanten (VSF) http://www.vsf-mills.ch:80/ (in French and German)