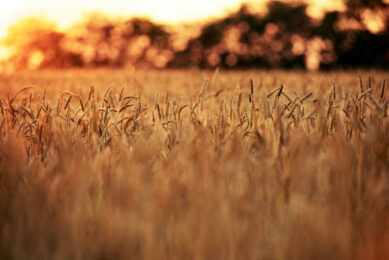

Russia sets the tone in grain trade

The October edition of the Wasde report, which was published on Friday, has not been the topic of discussion in wheat trading circles in recent days. Other developments attracted attention. Algeria’s decision to boycott French grain and Russia’s plan not to offer wheat at low prices on the international market.

The US Department of Agriculture’s Wasde report shows a slightly smaller estimate of world wheat production: 794 million tonnes compared to 796.9 million tonnes in September. But wheat consumption is forecast to decrease, from 804.9 to 802.5 million tons. Closing stocks increased slightly, from 257.2 to 257.7 million tons. In short: not much has changed compared to the forecast in September.

‘The dumping must end’

There are a few other developments that are attracting attention. One of them concerns Russia, which plans to stop supplying the world market with wheat at very low prices. The dumping must end, the Russian Ministry of Agriculture has told exporters, Reuters news agency reports. A floor price of $250.00 per ton of wheat would apply.

Will this bottom price be bottom?

That would be beneficial for the EU, but analysts are not convinced. The message could also be a sweetener for the Russian population, who supposedly do not have to fear that abroad will make off with cheap Russian wheat, while shortages may occur at home. It remains to be seen whether this bottom price will actually be a bottom price.

No more French wheat to Algeria

Furthermore, Algeria has announced that it no longer wants to purchase French wheat as a result of renewed diplomatic tensions between Algiers and Paris. Algeria will purchase 570,000 tons of milling wheat from Russia in December and January. Egypt bought 3.1 million tons of Russian wheat for delivery November through April. The EU will therefore lose some sales markets for the time being.

Dutch wheat

Meanwhile, Dutch growers are still waiting to sell their wheat. As a result, stocks are small on local markets, according to a trader. “That could soon lead to a rise in prices.”