Aquafeed market outlook: Asia and beyond

Production trends for various species, aquafeed demand factors and more

The power of the Asia-Pacific area in the aquafeed industry, note the authors, “can be linked to the region’s aquaculture industry’s rapid expansion. The availability of inexpensive labour, the creation of conditions that encourage the expansion of aquaculture, and the occurrence of natural resources in the area have all contributed to this growth. Over the past 10 years, the Asia-Pacific market has grown quickly, accounting for more than half of all regional sales.”

Chinese aquafeed market

China is currently the leading producer, consumer and exporter of aquafeed globally, mainly because China has dominated global aquaculture production for almost 20 years.

“In 2019, a coastal fishing ban in China led to growth in the aquaculture and marine culture, which further increased the growth of demand for fish feed, thus increasing the need to produce high-quality and more formulated feeds in the country,” state the IMARC analysts.

“In addition to this, the Chinese government is taking various initiatives to strengthen the aquaculture industry in order to increase its production share in the international market.”

Other regions

Market Research Future also notes that the aquaculture industry is expanding significantly all around Europe, particularly in the UK, France, Italy and Spain. This has been spurred by advancements in environmental management, as well as a major improvement in feed efficiency and nutrient intake. North America has also seen rapid expansion of the aquafeed sector, and this growth is expected to continue.

Overall, this firm predicts that the aquafeed market will reach US$ 87 billion by 2027, at 6.80% CAGR.

Demand for farmed fish

Aquafeed markets are clearly growing because demand for cultivated fish, shrimp and more is growing around the globe.

Indeed, of all animal protein production, according to the Rabobank Animal Protein Outlook 2023 report, aquaculture leads global growth. “Poultry is set to maintain its consistent growth pattern, although the expansion will be more modest given various pressures,” the authors state. “Beef production is set to decline slightly, as a contraction in the US will outweigh expansion in Brazil and Australia. Pork will see a decline, largely as a result of ongoing contraction in Europe, with little change elsewhere.”

Positive outlook

In the new Rabobank report, What To Expect in the Aquaculture Industry in 2023, Senior Global Specialist (Seafood) Gorjan Nikolik and his colleagues note that those who attended the 2022 Global Seafood Alliance (GSA) GOAL Conference remain optimistic about long-term growth in aquaculture.

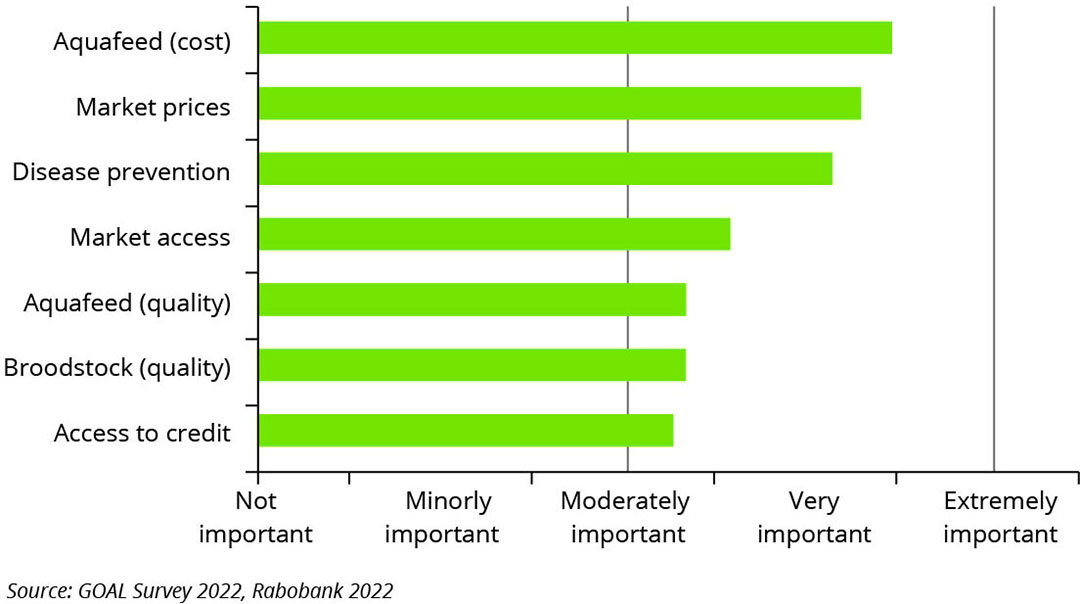

Figure 1 – Feed costs back as the top concern for industry

participants, 2022.

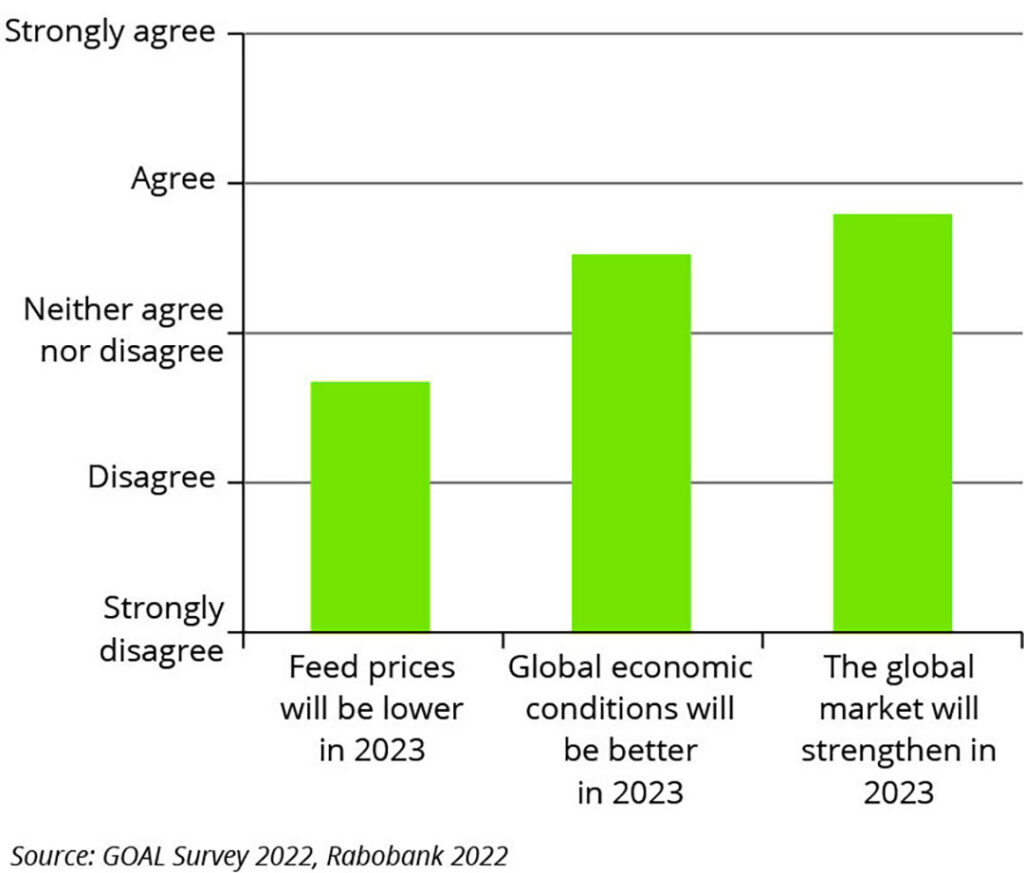

This is despite increasing concerns about costs and market conditions (Figure 1 and Figure 2). In particular, positive signs can be found in the fact that global shrimp supply is increasing and growth in salmon farming is expected to return to normal in Norway and Chile.

Figure 2 – Industry pessimism due to economic and market uncertainties, 2022.

Technification within aquafeed

Nikolik and his colleagues note that shrimp production in Ecuador surpassed 1.35 million metric tonnes (MT) last year, adding over 300,000 MT (about 30%) – which is equivalent to adding in one year close to what Thailand currently produces each year.

“‘Technification’ is happening with increasing farm densities and the use of the latest technologies,” Nikolik explains. “Feeding is automated using acoustic sensors, and management is the best in the world. Shrimp growth rates and other performance aspects such as mortality greatly surpass those of Asian production. There is also an abundance of land with good quality water in Ecuador.”

Shrimp production

“Also, Ecuador is very competitive, with the lowest-cost shrimp production in the world due its business model. The industry mainly consists of large integrated companies each with hatcheries, grow out, processing and distribution, often with export as well.”

Asia, the region of the world that produces most of the global shrimp supply, experienced a very small reduction of production in recent times, but Nikolik and his colleagues expect that production there will rebound with production growth of over 4%.

“There will be higher production in China and India and a slight increase in Vietnam, pushing Asian production above 4 million metric tonnes in 2023,” says Nikolik. “China in particular will likely grow by 9.5%.”

Salmon

Production of salmon has changed significantly over the last few years. Nikolik explains that in 2021, Norway expanded year-on-year supply by 11.9% and Chile contracted by 7.7%.

“During 2022, there was basically no growth, but we expect that volume will expand by about 3% in 2023 and move up to 5% in 2024,” he says. “At the same time, cumulative supply growth for Norway and Chile is expected to drop somewhat in 2024. This is due to governments limiting growth to meet environmental goals and to safeguard biosecurity.”

This, says Nikolik, creates an opportunity for Iceland and the Faroe Islands to produce more salmon.

Tilapia and Pangasius

Overall, global tilapia supply growth is accelerating, with expected year-on-year growth of 4.3% in 2022 and 4.8% in 2023.

Latin America leads the growth in production of this fish, but production is also much higher in China, Egypt and Indonesia. In Brazil, the leading producer in Latin America, tilapia farming has grown from almost nothing 10 years ago to present levels due to the import of new genetics. Expansion of the industry in Brazil is currently very strong, says Nikolik, about 8% CAGR according to survey results.

Pangasius is a medium-large freshwater shark catfish native to South and Southeast Asia. In the pangasius market, Nikolik and his colleagues note that global supply has seen a slowdown from the major global supplier, Vietnam, with supply still to recover following a decline in 2020.

In 2023, India, Indonesia and Bangladesh will also experience some pangasius production growth. There is also some cultivation of this fish in China and Latin America.

Feed market – 2 main factors

In 2023 the aquafeed market (with fishmeal, soybeans, corn and wheat being the main ingredients globally) will be affected by two main factors, notes Nikolik: inflation and volatility.

“Aquafeed prices have consistently been the top concerns for fish farmers over the past few years,” he says. “The war in Ukraine has added a lot of volatility in the markets for feed ingredients, which led to a supply shock and sent prices soaring. This has pushed aquafeed prices to the top as fish farmers’ primary concern heading into 2023, with low expectations for prices to decline in 2023.”

Nikolik thinks that global aquafeed prices peaked in the second quarter of 2022. Prices have eased marginally since then due to easing of the prices for soy, corn and wheat, but fishmeal costs remain high. However, Nikolik predicts salmon feed cost per kg of salmon produced will be higher in 2023 compared to 2022.

Other market influences

Market Research Future notes that demand for plant-based aquafeed will grow, driven by a demand for organic and natural feed products, the newest industry trend. There is also growing demand for aquafeed in the medical industry where the shells of crabs and other crustaceans are used to prevent and treat inflammatory diseases.

The authors note that several government programmes and initiatives have been implemented in various global regions to encourage farmers to use high-quality feed. Market growth is predicted to be boosted by favourable government norms and regulations, such as the acceptance of the use of insect protein in aquafeed.

Market restraints

Aquafeed market growth could be curbed, explain the Market Research Future analysts, by the high price volatility of raw feed ingredients.

“For instance, a rapid rise in the price of soybeans, maize, or other natural resources might directly affect the final price of the product, leading to lower sales. In addition, more people are adopting a vegan lifestyle while others avoid non-vegetarian cuisine, which is anticipated to reduce demand for fish and thus negatively affect the market.”