The technological edge for animal feed producers

As with other industries that rely on laboratory analysis, the feed industry is increasingly looking for ways to blur the lines between the lab and the field. Portable devices are a relatively new edition in this.

By Bill Grube and Igor Nazarov of Thermo Fisher Scientific, USA

The increased global demand for meat has put increasing pressure on feed mills to become more efficient. While population growth has been the main contributor, feed manufacturers are locked between fluctuating raw material costs and relatively stable food prices. Additionally, the feed industry continues to experience massive consolidation, and today fewer feed manufacturers are required to produce more tonnage. Meanwhile, requirements to develop and produce higher-performance feed necessary to nourish new breeds or improve the quality of existing breeds has led to increasing demand for better processes, automation and new technology to thoroughly analyse and optimise raw materials. Roughly 70% of the cost of producing meat comes from the cost of feed, and today’s feed manufacturers are rapidly modernising to meet the demands of a highly complex and rapidly changing food industry.

Globally, compound feed production has now reached an estimated one billion tonnes per year, and the industry generates more than $370 billion (€293 billion) in annual revenue. At the producer level, this massive market is highly complex and the average consumer could not fathom the rigor that goes into manufacturing specialty feed for varied livestock diets. Compound feeds can contain a wide range of ingredients – from three to more than 30, including additives – and final mixtures must be manufactured precisely.

The role of technology

Over the past decade, the feed industry has turned to advanced technology to improve the precision of the mixing process. The use of spectroscopy is well known, and today near-infrared (NIR) instruments are routinely used for the detection and quantification of ingredients across the industry. But as the industry has become more sophisticated, and so must the technology that supports, while still maintaining usability.

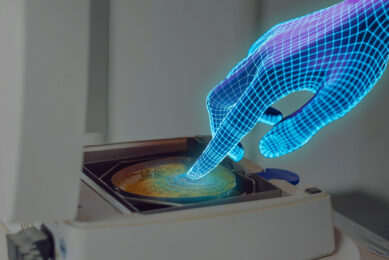

As with other industries that rely on laboratory analysis, the feed industry is increasingly looking for ways to blur the lines between the lab and the field. Portability is becoming more important in an industry where delays across a massive supply chain will cut into razor thin margins. Because profits depend so much on raw material cost and quality, manufacturers are constantly looking for a technological edge. Using portable instruments to complement those in the lab can provide the critical edge that many manufacturers have been seeking. By eliminating the need to ship samples to centralised labs or test them on in-house bench top NIR systems, handheld analysers provide fast, actionable results at the point of need. As a result, users who do not have a technical background can easily and quickly obtain accurate results with very little training and experience. The library and calibrations allow the instrument to be an out of the box solution that can be customised with personalised applications.

Application in pet food

A recent example highlights the advantages of portable spectroscopy. A US food manufacturer brought the microPHAZIR AG instrument onsite to analyse protein levels during production. Using the instrument, the team sorted raw materials, labelling them as ‘acceptable’, ‘higher than acceptable’ and ‘lower than acceptable’ based on industry requirements. Once labelled, the batches can be blended into future mixtures to meet a precise specification. This is all done onsite and rapidly, limiting production delays without sacrificing quality. The applications for portable NIR technology are myriad. In addition to analysing compound feed, the instrument can be used to ensure the quality of forages.

The same portable technology that is now revolutionising the animal feed industry is equally transformative in the pet food industry. According to the latest statistics from the Pet Food Institute (PFI), food sales for cats and dogs alone reached $19 billion (€15 billion) in 2012. And during this time the industry has changed dramatically – today consumers are hyper focused on ingredient quality and mixture. So too are regulators – the pet food industry is highly regulated and subject to strict ingredient and labelling requirements.

From a profitability standpoint, manufacturers must be mindful of nutritional quality in terms of shelf life and other variables. This makes analysis of moisture content, for example, a critical part of processing workflow, and portable instruments can play an important role throughout the pet food supply chain. The ability to test at multiple stages in the supply chain is important for traceability as well as quality. By mandating upstream and downstream testing more broadly, manufacturers can identify where problems exist and mitigate them before they reach store shelves. With increasing scrutiny industry-wide, pet food manufacturers must be more vigilant than ever – discovery of an inferior product, by consumer groups or regulators, can be damaging to a brand and seriously affect profitability.

Achieve new levels of growth

The feed industry is dynamic, from changing dietary requirements and new breeds to consolidation and regulation. The Animal Feed Regulatory Program Standards, for example, which are intended to bring uniformity to the industry, may be voluntary, but industry leaders will certainly be expected to comply – all the more reason to accelerate the adoption of new technologies across the supply chain.

For feed manufacturers, the demand for greater efficiency, transparency and performance will only increase. To stay ahead of the competition – and avoid costly quality control issues – the industry will continue to adapt, and technologies such as portable NIR will play an increasingly important role. Moving precision and efficiency from the lab to the wider supply chain is one way that smart feed producers can achieve new levels of growth in a global economy that now, more than ever, won’t tolerate inferior food at any stage in the production lifecycle.

Source: AllAboutFeed, Volume 22, Number 9, 2014