Industrial Compound Feed Production

The National feed production in South Africa reflects the feed produced by both AFMA and non-AFMA members and it is based on the requirements of the livestock in the country. As the only calculation of its kind in South Africa, it is widely used by various role players in agriculture. This calculation was done in 2004 and was updated in 2006.

PRODUCTION

There was a shift in feed production between the formal

industry (AFMA members) and the rest of the industry. AFMA’s share of the total

feed requirements decreased from 59.15% in 2004 to 58.08% in 2006.

During 2005/06 feed sales increased by 3.46% to 4,462,088 tonnes. Total South

African compound feed production is estimated at 8,687,220 tonnes.

(Source: Animal Feed Manufacturers

Association, AFMA)

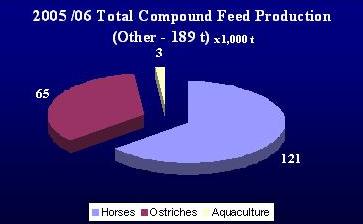

| Break-down of Total Feed Production (Other) |

The rate of increase in raw material prices slowed down and swung around to

decrease. This was mainly caused by the drop in maize price due to the

overproduction. Average annual growth of feed sales is around 3%. No detailed

data is available for feed sales of non-AFMA members.

| |

FEED

Feed for cattle can be split up in feed for dairy and for beef cattle. Also

feed for sheep is included and could not be extracted from the data. The figures

also include the volume of concentrates that has been sold. Concentrates take

less than 10% of feed sales.

Dairy feed takes the largest share of the cattle feed market. In 2005/06 a

little bit more than 560,000 tonnes were sold. This was a decrease of 10%

compared to the previous marketing year. However, dairy feed sales have showed

fluctuating figures in the previous years.

FEED

On the concentrate side, the impact of the large maize crop and lower maize

prices can clearly be seen with on farm mixing increasing, therefore only buying

concentrates from AFMA members. Growth in sales of more than 20% was achieved in

almost all categories except for pigs. This is reflected in the inconsistent

annual volumes that were sold.

The pig industry is however predominantly a home mixing market and the swing

towards pigs wouldn’t have been expected to be significant.

FEED

Poultry feed sales of AFMA members shows a gradual increase over the years.

Feed for broilers take about two thirds of total volume. Layer feed accounts

for about 20% of the sales and feed for broiler breeders has a 10% share of

total poultry feed volume.

In feed for layers there is a shift from compound feed (-1.65%) to

concentrates (+63%), but this does not compensate for the small decrease in

total layer feed. Feed sales for broilers shows a steady rise.

FEEDS

Other major feeds

that are produced in South Africa are feeds for horses, dogs, ostriches and

fish. The steady decline is mainly caused by the rapid deteriorating ostrich industry.

In 2001/2002 annual sales were 49,505 tonnes. In 2005/06 this figure came

down to 17,700 tonnes, a decline of more than 35%.

Fish feeds have almost doubled from a steady 1,700 tonnes in 2003/04 to 3,163

tonnes in 2005/06.

Furthermore in 2005/06 almost 19,500 tonnes of horse feed was sold by AFMA

members and about 33,200 tonnes of dry and wet dog food.

During the

last couple of years various changes took place in the feed

industry and more particularly amongst AFMA members. A number of new feed mills have

joined AFMA, some new feed mills were built, some were closed and various members

upgraded their feed mills.

In view of these changes, it was decided to conduct another capacity

utilisation survey in the industry to determine the current capacity. The survey

was done in July 2005 and the result was an utilisation of 75% which is

significantly less than the 86% that we have been using in recent

years.