Industrial compound feed production

Animal feed in India is currently evolving from a fragmented industry into an organised sector. The compound Livestock Manufacturers Association (CLFMA) estimates domestic demand for compound feed in India currently at around 45 million tonnes and is expected to grow to around 68 million tonnes by 2010.

FEED

Poultry feed is the largest segment in this industry and

includes both broiler feed and layer feed. Feed practices in the country are

sufficiently advanced and typically involve the use of compound feed instead of

feeding grains or foraging. With increasing integration within the poultry

industry, the use of compound feed has also increased. The poultry feed

segment’s growth has been fuelled by the broiler industry where both consumption

and production have been growing at an annual growth rate of 9% over the last

five years.

The layer bird industry has also been growing and India is

currently the sixth largest egg producer in the world. Only 10% of compound feed

production is for commercial purposes. This is primarily because despite the

high cost of feed, the use of compound feed does not results in higher egg

yields as the feed also increases the risks to the birds.

The feed production by the organised sector was around 1.5

million tonnes of which broiler feed production was around 1.0 million

tonnes.

However, industry estimates show that the total poultry feed

requirement in India was 14.3 million tonnes in 2004, of which 6.2 million

tonnes is estimated to be broiler feed. This highlights the importance of the

large number of unorganised players (who are primarily home mixers), although

the organised sector is expected to become increasingly important as more and

more independent poultry farmers are being incorporated as contract farmers by

the integrated players.

Source: Rabobank

| Source: CLFMA, Rabobank |

FEED

The cattle feed segment is also a segment for potential growth

given the fact that Inida is largest producer of milk in the world.

Production is expected to grow 4% at an anuual basis. India’s

yearly production of 91 million tonnes of milk implies that the potential market

for cattle feed should be approximately 45 million tonnes annually.

However the vast majority of cattle and buffalo in India are

fed through grazing and the use of basic mixes and concentrates and the market

for compound feed is estimated to be around 5.5 million tonnes.

The private players produce around 1.2 million tonnes; the

dairy cooperative sector produces around 2.5 million tonnes of low cost feed

that is sold to member farmers involved in milk production. The rest is produced

by home mixers.

Source: Rabobank

| Source: CLFMA |

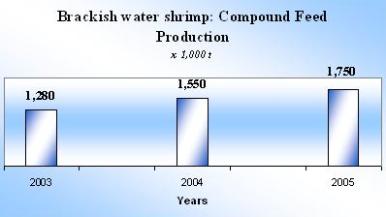

Aquafeed is the third major segment in the Indian animal feed

industry. It comprises primarily shrimp feed and fish feed, with shrimp feed

being the dominant type of feed, as the segment is largely dependent on marine

exports (60% of volume, 86% of value). Prodcutin of brackish water shrimp feed

was around 155,000 tonnes in 2004.

Approximately 10,000 tonnes of shrimp feed was imported in

2004. Production of freshwater shrimp feed in 2004 was estimated to be around

100,000 tonnes, while fish feed production was app. 10,000 tonnes.

| Source: Rabobank (note: 2005 figures estimated) |