USDA projects high crop prices

The US Department of Agriculture has recently released its ten-year outlook, this time stretching to 2020. Steady growth of crop demands is projected with historically high prices. In livestock further growth is expected, but strong figures as in the past years will not be reached.

Global economic recovery with steady growth provides an improved foundation for demand for crops over the next several years and through the remainder of the projection period to 2019.

Although growth in corn-based ethanol production in the United States is projected to slow, the large expansion in recent years keeps this use of corn high.

In combination, these factors support longer run increases in global consumption and trade, with prices for many crops remaining at historically high levels.

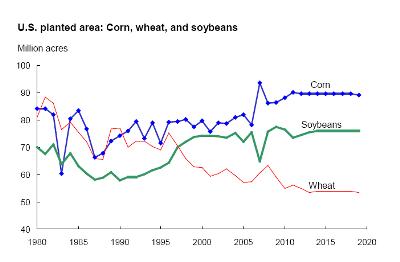

Plantings of different crops are influenced by expected net returns. Net returns are primarily determined by market prices, yields, and production costs.

Producer planting decisions are also affected by revenue protection available through the Federal Crop Insurance program and the Average Crop Revenue Election (ACRE) program, a new program under the 2008 Farm Act which started in 2009.

- Continuing high levels of domestic corn-based ethanol production and gains in exports keep corn demand high. Strong producer returns keep corn acreage in a range of 88 to 90 million acres over the projection period.

- Soybean plantings decline over the next several years from the high level in 2009 as producer returns are reduced due to the influence of higher carryover stocks. As stocks are reduced in subsequent years, returns improve and plantings increase to 76 million acres.

- Wheat plantings initially fall as producer returns are lower and late-harvest of some 2009 crops has prevented some winter wheat plantings. With relatively weak overall demand growth and continuing large stocks, producer returns remain lower than in recent years, leading to a decline in wheat plantings to about 54 million acres through much of the projection period.

US livestock

The livestock sector continues to make adjustments in the first several years of the projections in response to high grain and soybean meal prices in 2007 and 2008, followed by weak meat demand caused by the global economic recession.

With producer returns squeezed, production incentives fell, leading to declines in total US meat and poultry production through 2011.

These production adjustments combine with strengthening meat exports to reduce domestic per capita consumption through 2012. The result is lower production at higher prices, which improves net returns and provides economic incentives for moderate expansion in the sector later in the projection period.

Cattle inventory down

Higher grain prices and reduced demand push cattle inventories down through the start of 2011 and result in US beef production declines in 2009-12. Beef production then rises in the remainder of the projection period as returns improve and herds are rebuilt.

The total cattle inventory drops below 92 million head before expanding to about 94.5 million at the end of the projection period.

Rising slaughter weights also contribute to the moderate expansion of beef production beyond 2012. Continued high feed costs are expected to result in stocker cattle remaining on pasture to heavier weights before entering feedlots.

Per capita beef consumption declines through the first half of the projection period, before rising somewhat over the last half. The initial decline reflects a lagged response in beef production coupled with continuing expansion of exports.

However, as beef production expands more rapidly in the second half of the decade, per capita consumption grows.

Pork production up

Pork production declines in 2009-11 in response to high feed prices and lower demand and then grows for the remainder of the projection period as higher hog prices improve returns. However, high feed costs are expected to limit growth in producer returns.

Reductions in pork production combine with rising pork exports to push per capita pork consumption down in 2010-12.

A gradual rebound in per capita pork consumption occurs over the remainder of the projection period as production gains strengthen.

Poultry to grow at slower rate

Poultry production fell in 2009 but is projected to rise the most among the meats over the next decade, as poultry is the most efficient feed-to-meat converter. Growth will remain below rates of the past decade.

Due partly to higher feed conversion rates and a shorter production process, the poultry sector has adjusted faster than red meats to the combination of higher feed costs and reduced demand.

As a result, poultry production is projected to resume growth in 2010. As producer returns improve, production strengthens further.

Per capita consumption rises through the end of the projection period and, in contrast to red meats, surpasses levels of the past decade.

Consumption and exports

Continuing near-term production reductions in the livestock sector, along with some recovery in meat and poultry exports, result in higher consumer prices and lower per capita consumption.

Annual consumption of red meats and poultry falls from over 100 kg per capita in 2004-07 to less than 93 kg in 2012.

As production increases over the remainder of the projection period, per capita consumption of red meats and poultry resumes growth, but only rises to about 97 kg by 2019.

Price developments

After the price declines seen in the livestock sector in 2009, largely due to recession-related effects on meat demand, prices rise over the projection period. A moderate pace of expansion combined with improving domestic and export demand support prices in the projections.

Reduced demand resulting from the global recession lowered overall US meat and poultry exports in 2009 by more than 7%. After 2009, exports are projected to rise as global economic growth resumes and the US dollar depreciates.

With this growth, exports account for a growing share of US meat use, although the domestic market remains the dominant source of overall meat demand.

Related website:

The above is an extract from this year’s USDA’s Agricultural Projections to 2019, published this month.