Egypt: High wheat and corn imports expected in 2024

A recent USDA GAIN report highlights how, Egypt, one of the world’s largest wheat importers has been adversely affected by Russia’s invasion of Ukraine, resulting in high wheat prices.

In the marketing year (MY) 2023/24 wheat imports are expected to increase compared to the marketing year 2022/23 due to a lower area of production. Similarly, corn imports are estimated to increase as higher corn area is more than offset by increased heat stress and insects.

Wheat and corn imports

The Russian invasion of Ukraine has driven wheat prices and caused Egypt to seek more Russian wheat imports compared to other countries such as Ukraine. During the Egyptian marketing year (MY) 2023/24 (July – June) wheat imports are estimated at 12 million metric tons (MMT), up by 6.9% from MY 2022/23 due to lower area of production. Corn imports are estimated at 6.5 MMT in MY 2023/24, an increase of 8.3% from the previous year as higher corn area is more than offset by increased heat stress and insects.

The largest exporters to Egypt in MY 2022/23 were:

- Russia (8.1 MMT),

- the EU (1.8 MMT),

- Ukraine (856,377 MT), and

- Australia (172,015 MT).

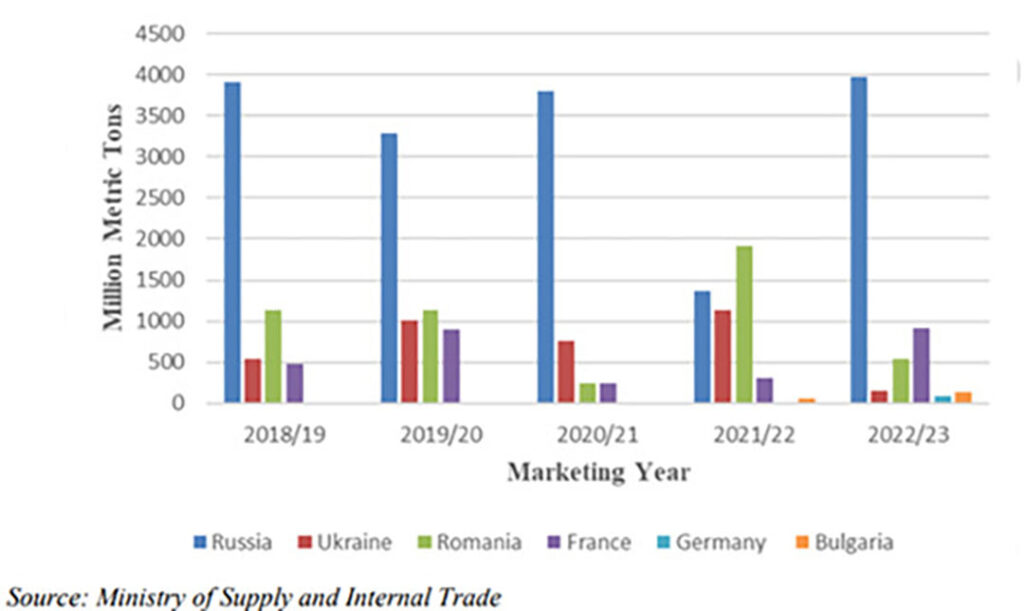

The General Authority for Supply Commodities’ (GASC) wheat imports accounted for 50.5% of total imports in 2023 (Jan- August), while the private sector accounted for the rest. In MY 2022/23 (July-June) GASC imported about 5.8 MMT of wheat to support human consumption, with a clear significant decrease in imports from Ukraine compared to MY 2021/22 (Figure 1).

Figure 1 — GASC wheat imports by marketing year

Wheat production and consumption

Wheat production during the marketing year 2023/24 (July – June) is estimated at 8.87 million metric tons (MMT), down 6.6% from MY 2022/23. This is due to the area harvested, decreasing to 1.35 million hectares (HA) compared to 1.45 million HA in MY 2022/23. The decrease in area is driven by the increased area of Egyptian clover and sugar beets.

To encourage production, the Government of Egypt (GOE) has increased the procurement price of wheat by almost 70% over the previous marketing year to encourage farmers to sell their wheat to government wheat purveyors and motivate farmers to cultivate more wheat. On April 12, 2023, the GOE raised the local procurement price to 1,500 Egyptian pounds (EGP) per ardeb (one ardeb=150 kilograms). On November 2, 2023, the GOE announced a new procurement price of 1,600 EGP/ardeb ($346.30/MT) for the 2024 wheat harvest season. Because of the new procurement price, an increase in the area planted for wheat in MY 2024/25 is expected to increase by more than 10-12% compared to the previous marketing year (2023/2024).

Wheat consumption in MY 2023/24 is estimated at 20.6 MMT, up by 50,000 MT from MY 2022/23. This is due to an increase in food, seed, and industrial use consumption. The rise in industrial use of wheat consumption is attributable to population growth. Egypt’s population (excluding immigrants) is expected to reach 124 million by 2030. Similarly, feed consumption will grow in 2024 with poultry feed consumption forecast to grow by 3% as larger producers consolidate, vertical integration increases, and broiler consumption rebounds. A reduction in production and an increase in consumption are both important drivers for increased wheat imports in 2024.

Corn production and consumption

The estimated MY 2023/24 (October – September) corn production is 7.2 MMT, down from MY 2022/23 by about 3.2%. The decrease is due to excessive heat during the growing season and high insect pressure – mainly the fall armyworm, causing lower kernel counts and reduced yield throughout the region from July to August.

Consumption dropped due to Ukrainian/Russian conflict

Corn consumption in MY 2023/24 (October – September) is estimated at 13.8 MMT, up by 2.2% from the MY 2022/23 estimate. Feed consumption in 2022/23 was reduced as the war in Ukraine increased international prices and contributed to a foreign currency crunch in Egypt, where the Egyptian pound lost almost half of its value against the US dollar. However, the poultry sector’s feed consumption is expected to grow in MY 2023/24, as larger producers consolidate, vertical integration increases, and broiler consumption rebounds. The Ministry of Agriculture and Land Reclamation (MALR) has continued to increase licenses for livestock and poultry, facilitating the procedures to obtain these operational approvals.

International funding aided import rise

Besides the reduction in production and increase in consumption, another important contributing factor to the increase in imports is international funding. The war on Ukraine disrupted wheat trade and increased wheat prices, promoting the country’s foreign currency crunch; however, Egypt has recently received support from international donors including the World Bank, the International Islamic Trade Finance Corporation (ITFC) and the African Development Bank (AFDB) to finance wheat purchases in foreign currency.

The latest of these financing agreements is a $500 million financing agreement with the Abu Dhabi Exports Office (ADEX), and Al Dahra Co, an Abu Dhabi agribusiness. ADEX and AL Dahra Co. will supply wheat to Egypt under a 5-year agreement starting in 2023. The agreement, worth $100 million per year, will provide Egypt with high-quality milling wheat either through direct purchases or tenders.